Treasury bill calculator

Treasury bills are offered in multiples of 100 and in terms ranging from a few days to 52 weeks. Then click the calculate button to see how your savings add up.

6 1 Application Of The Time Value Of Money Tool Bond Pricing Bonds Long Term Debt Instruments Provide Periodic Interest Income Annuity Series Return Ppt Download

Bills are typically sold at a.

. AARP Money Map Provides a Trustworthy Actionable Plan Based On Your Current Funds Debts. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Our Resources Can Help You Decide Between Taxable Vs.

A b and c. Do Your Investments Align with Your Goals. To use this calculator you must enter the numbers of days late the amount of the invoice in which payment was made late and the Prompt Payment interest rate which is pre.

Treasury Bills Pricing Calculator Re-Discounting Calculator Treasury Bonds New Bonds Calculator Re-Opening Calculator Re-Discounting Calculator. In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. Find our accurate online Treasury Bill Calculator Treasury Bond Calculator and RepoReverse Repo Calculator to compute values for your Securities.

29th September 2022 Value Dated. Feel free to change the default values below. For more information click the instructions link on this page.

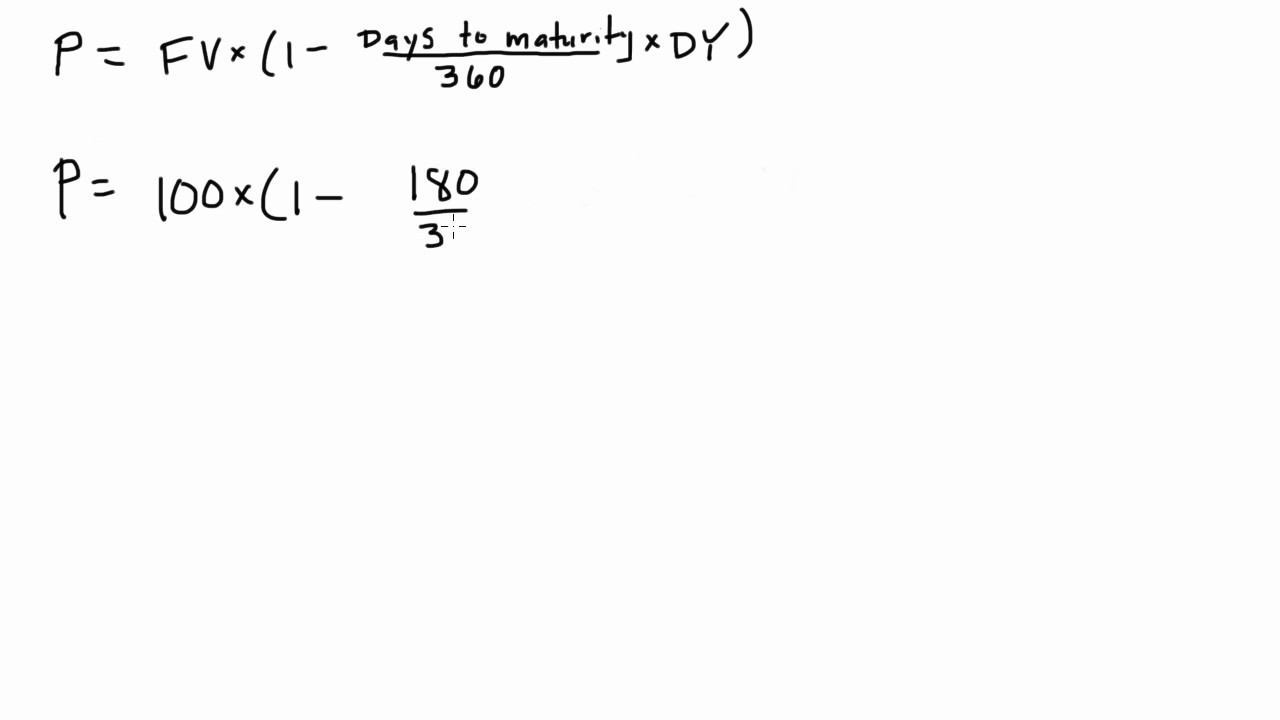

Its easy to plan ahead with our estimation calculators. Value Date Investment Date Investment term Tenure Duration days Face Value Amount to invest Interest Rate Average Yield Discount Rate. Bills are typically sold at a discount from the par amount par amount is also called face value.

3rd October 2022. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Please dont use commas when inputing values MaturityFace Value.

Treasury bills or T-bills are sold in terms ranging from a few days to 52 weeks. T-Bill prices tend to rise when the Fed performs expansionary monetary policy by buying Treasuries. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Build A Better Financial Future By Doing So. Note that M is equal to 91 day s for a 90-day T-bill because the official maturity term is 13 weeks 13 x 7 91.

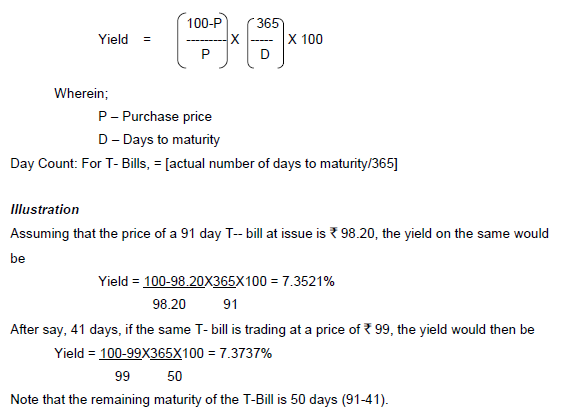

The Government issues treasury bills at a discount from par at zero coupon rate for maturities of less than 1 year usually 91 days or 182 days or 364 days. Calculate the interest received from Treasury Bills from any bank. They can help approximate the future value of your savings bonds and show how much and how long it will take to reach.

In this formula they are addressed as. Conversely T-bill prices fall when the Fed sells its debt securities. Value Date Investment Date Investment term Tenure Duration days Face Value Amount to invest Interest Rate Average Yield Discount Rate.

At maturity the investor. Ad Take Control of Simplifying Your Debt. Previous Average Interest Rate.

Find a Dedicated Financial Advisor Now. For example if the average price of a 90-day T-bill with a par. Maturity Date should be between startDate.

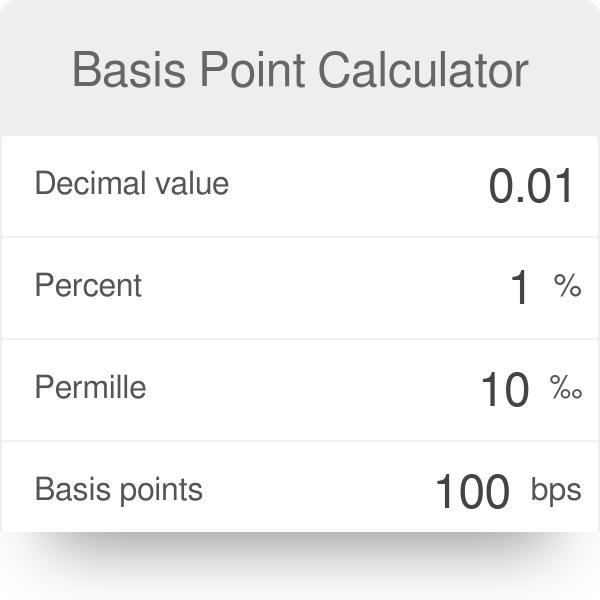

Basis Point Calculator

How To Calculate The Percentage Return Of A Treasury Bill Nasdaq

How To Use The Excel Tbillprice Function Exceljet

Net Present Value Calculator

Calendar Anomalies In Treasury Bills Rate In Ghana

Current Yield Bond Formula And Calculator

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Yield To Maturity Ytm Formula And Bond Calculator

Computation Of Treasury Bill Price From Quoted Rate Frm Part 1 And Cfa Level 1 Youtube

Chapter 6 Bonds And Bond Valuation Learning Objectives

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Treasury Bill Investment Choosing Between 91 Day 182 Day 1 Year Note

What Is A Principal Interest Payment Bdc Ca

Treasury Bill Calculator Programu Zilizo Kwenye Google Play

Current Yield Bond Formula And Calculator

Treasury Bill Discount Yield Example 1 Youtube

Reserve Bank Of India Frequently Asked Questions